Pay later with Bumper

Make car repair & Servicing more affordable

Spread the cost over 3-6 payments. Interest-free. Repair now, pay later.

How it works

See just how quick and easy it is to pay later with Bumper

Apply & Spread the COST, Interest-free

It’s as simple as:

1

Click GET STARTED!

2

Apply for your credit limit up to £5000. Bumper doesn’t need to know how much your bill will be.

3

Get approved instantly and get a unique bumper code.

4

Book your appointment and we’ll do the rest.

WHAT WILL MY PAYMENTS BE!

When screening the cost of your repair, simply give our service advisor your bumper code.

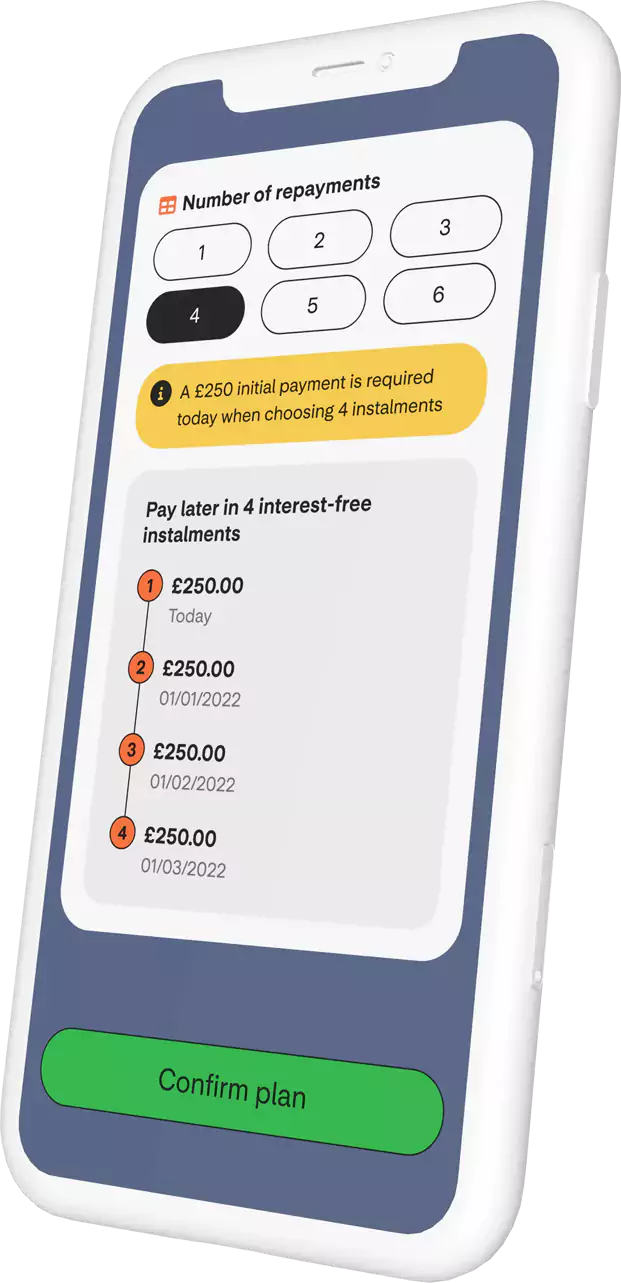

We’ll send you a link to set up your plan on your smart phone, or face to face using Bumpers secure platform.

You can pick the number of months you’d like to spend the cost over and choose a repayment date that suits you.

You’ll never pay more for your servicing or repair bill when spreading the cost. And, we’ll never inform the partner about your Credit Limit or share any of your information without your consent.

PAYMENT CALCULATOR

How do our plans work?

The calculator is illustrative, so play around to get an idea of how much each repayment could be.

The number of repayments, the amount of credit and the need for a deposit changes depending on the partner you choose, but it will always be interest-free!

Ways you can spread the cost.

Delay the cost of your repairs by up to 40 days by splitting your repayment over

1 to 3 monthly instalments

When spreading the cost over 3 or more repayments, pay your first instalment on the day.

Spread the cost over a maximum 5 months (6 repayments including the first due on the day)

questions?

A few common questions that you might be thinking.

Bumper charges Top Car Services a small service charge when you choose to split your payment. Bumper makes sure we never pass this charge onto you. That way we keep it all as simple as possible for you.

Bumper understands that sometimes things can go wrong and they are there to help you. If they are unable to collect a payment on the scheduled date, they will reattempt your payment within 7 days. They will also attempt to contact you to discuss your situation. They will only charge a late payment fee if you have not paid them within 7 days of the repayment date and they cannot agree a reasonable repayment plan with you. The late payment fee will be £20, unless your loan is under £200 in which case the fee will be 10% of your loan amount. They will also charge a reasonable fee if we need to instruct a third-party debt collection agency to assist us in collecting your loan. This step will only be taken if your loan is three payments in arrears and we cannot agree a reasonable repayment plan with you. If you think you are experiencing financial difficulties and are worried you are at risk of missing any of your payments, please contact Bumper and they will do their very best to help you.

Yes, Bumper will perform a soft credit check when you apply for a Credit Limit. This will not affect your credit score.

Bumper are obligated to make regular reports about the status of agreed payment plans. Therefore, these plans will show in your report. This can help to build your credit score as long as you are up to date with your payments.